Debt Obligations

As of Sept. 30, 2023:

Total outstanding tax-supported debt obligations are $845,020,000.

Tax-supported obligations per capita are $112.18.

Total voter-authorized obligations are $112,385,000.

Total senior lien obligations are $732,635,000.

Learn more by scrolling down this page.

Definitions

State law authorizes the Authority to impose a sales tax on the sale within the Authority’s boundaries of all items subject to the state sales tax and a use tax on the use, storage or consumption within the Authority’s boundaries of any such taxable items purchased, leased or rented from a retailer, at a rate established by the Board in accordance with the Authority Act. The Board has established the rate at 1%, as authorized by public vote when the Authority was confirmed in 1978. The sales tax and use tax is referred to herein as the “sales tax.”

Commercial Paper Notes

The Authority has established a $400 million commercial paper program (“CP Program”) for the issuance of Sales and Use Tax Revenue Commercial Paper Notes (the “CP Notes”) in multiple separate series. The current maximum issuance capacity of the CP Program is $165 million, which is the amount of authorized CP Notes secured by credit facilities. The CP Notes are Senior Lien Obligations payable on a parity with the Obligations.

Contractual Obligations

Contractual obligations may be issued as Senior Lien Obligations on a parity with the Voted Sales Tax Bonds and may be issued to finance vehicles and other personal property.

Senior Lien

Under current State law, in addition to the Voted Sales Tax Bonds and other sales tax bonds approved by future elections, the Authority may issue certain other Senior Lien Obligations without an election, specifically

(i) contractual obligations and (ii) commercial paper notes and Sales and Use Tax Bonds or notes with a five-year or shorter term.

Voter Authorized

In the 2003 Election, voters authorized the issuance of $640,000,000 of bonds payable from a pledge of 75% of the sales and use tax revenue collected by the Authority (the “Voted Sales Tax Bonds”) to

fund projects for its transit system. The Authority has issued all of the bonds authorized at the 2003 Election.

In November 2019, voters approved a referendum relating to the authorization of its regional transit plan — METRONext.

METRONext contemplates the implementation of a regional transportation plan, including capital improvements and infrastructure, and authorizes approximately $3.5 billion in debt to fund a portion of phase one of such plan.

Learn more about the METRONext Moving Forward Plan

The Authority may hold one or more future elections to authorize additional sales tax bonds; however, none are planned at this time.

Lease Purchase

The Authority has established a Master Lease Purchase Program for the lease-purchase financing from time to time of equipment, including buses, bus rapid transit vehicles and rail rapid transit vehicles. The lease-purchase

payments due under each lease purchase agreement are payable from sales and use taxes and other revenues, subject to appropriation on an annual basis, and are not secured by the Pledged Revenues. The Authority has entered into two lease-purchase agreements

under the Master Lease Purchase Program.

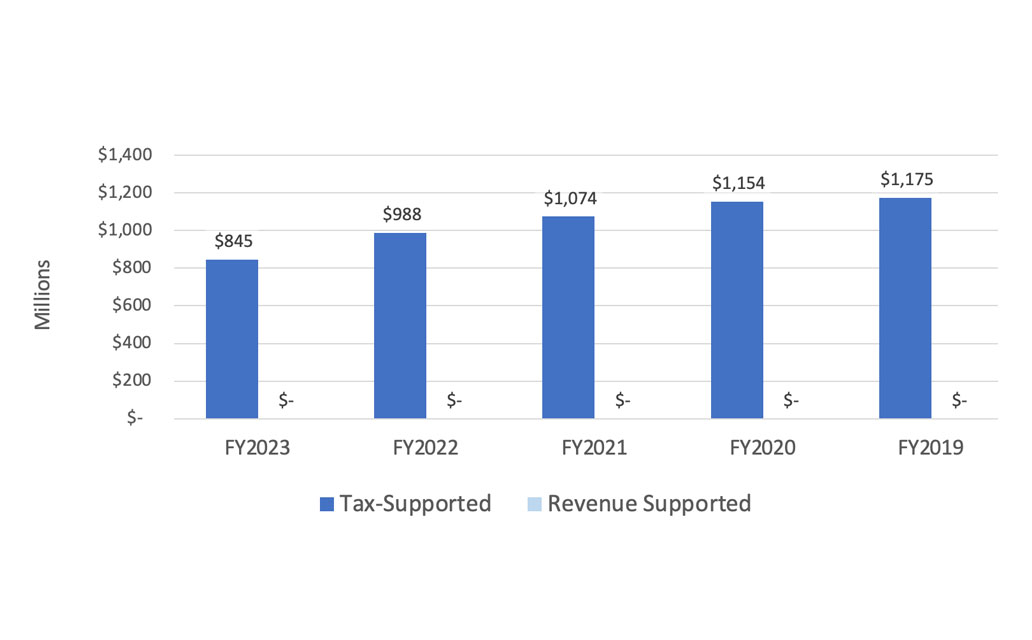

Historical Trends

Below, we show a five-year trend for total outstanding debt along with a corresponding table of five year inflation-adjusted, tax-supported debt per capita.

| Issuance | As of FY2023 | Obligation Type | Revenue Base |

|---|---|---|---|

| 2014 Sales & Use Tax Contractual Obligations | $18,345,000 | Senior Lien | Tax-Supported |

| 2015B Sales & Use Tax Contractual Obligations | $30,625,000 | Senior Lien | Tax-Supported |

| 2016D Sales & Use Tax Contractual Obligations | $26,665,000 | Senior Lien | Tax-Supported |

| 2016A Sales & Use Tax Refunding Bonds | $112,385,000 | Voter Authorized | Tax-Supported |

| 2017A Sales & Use Tax Refunding Bonds | $20,145,000 | Senior Lien | Tax-Supported |

| 2016B Sales & Use Tax Refunding Contractual Obligations | $22,785,000 | Senior Lien | Tax-Supported |

| 2017B Sales & Use Tax Refunding Contractual Obligations | $65,800,000 | Senior Lien | Tax-Supported |

| 2017C Sales & Use Tax Refunding Contractual Obligations | $22,805,000 | Senior Lien | Tax-Supported |

| 2018A Sales & Use Tax Contractual Obligations | $110,015,000 | Senior Lien | Tax-Supported |

| 2019A Sales & Use Tax Refunding Bonds | $64,120,000 | Senior Lien | Tax-Supported |

| 2019B Sales & Use Tax Refunding Bonds Taxable | $21,735,000 | Senior Lien | Tax-Supported |

| 2020A Sales & Use Tax Refunding Bonds Taxable | $292,160,000 | Senior Lien | Tax-Supported |

| 2021A Sales & Use Tax Refunding Bonds Taxable | $37,435,000 | Senior Lien | Tax-Supported |

| Debt Category | Fiscal Year 2023 | Fiscal Year 2022 | Fiscal Year 2021 | Fiscal Year 2020 | Fiscal Year 2019 |

|---|---|---|---|---|---|

| Tax-Supported | $845,020,000 | $988,105,000 | $1,074,480,000 | $1,153,720,000 | $1,175,385,000 |

| Revenue-Supported | - | - | - | - | - |

| Total | $845,020,000 | $988,105,000 | $1,074,480,000 | $1,153,720,000 | $1,175,385,000 |

| Debt Category | Fiscal Year 2023 | Fiscal Year 2022 | Fiscal Year 2021 | Fiscal Year 2020 | Fiscal Year 2019 |

|---|---|---|---|---|---|

| Tax-Supported | $845,020,000 | $988,105,000 | $1,074,480,000 | $1,153,720,000 | $1,175,385,000 |

| 9-County Metro Population* | 7,532,745 | 7,340,118 | 7,215,837 | 7,140,749 | 7,063,400 |

| Tax-Supported Debt Per Capita | $112.18 | $134.62 | $148.91 | $161.57 | $166.40 |

| Houston Consumer Prices (2022 base = 100)* | 103.3 | 108.2 | 104.7 | 100.1 | 101.1 |

| Derived CPI Multiplier (inflation adjustment to 2020 dollars) | 0.9787 | 0.9344 | 0.9656 | 1.0100 | 1.0000 |

| Adjusted Tax-Supported Debt Per Capita | $109.79 | $125.78 | $143.79 | $163.18 | $166.40 |

| Election Date | Proposition # | Purpose | Amount | Status |

|---|---|---|---|---|

| 11/4/2023 | Harris County Proposition A | Transportation Programs | $640,000,000 | Approved |

| 11/5/2019 | Harris County Proposition A | Transit System - Other Programs METRONext Moving Forward Plan Projects Including:

| $3,500,000,000 | Approved |

Note: There are no upcoming bond elections at this time.

Documents and Resources

Here you'll find links to valuable resources, including recent annual budgets and the page on which the debt service budget begins. Login credentials are not required to view any of the items shown below.

Google Chrome

Google Chrome

Safari Mac OS

Safari Mac OS

Mozilla

Mozilla

Microsoft Edge

Microsoft Edge